Private equity parent, CORE Industrial Partners, expands lighting portfolio

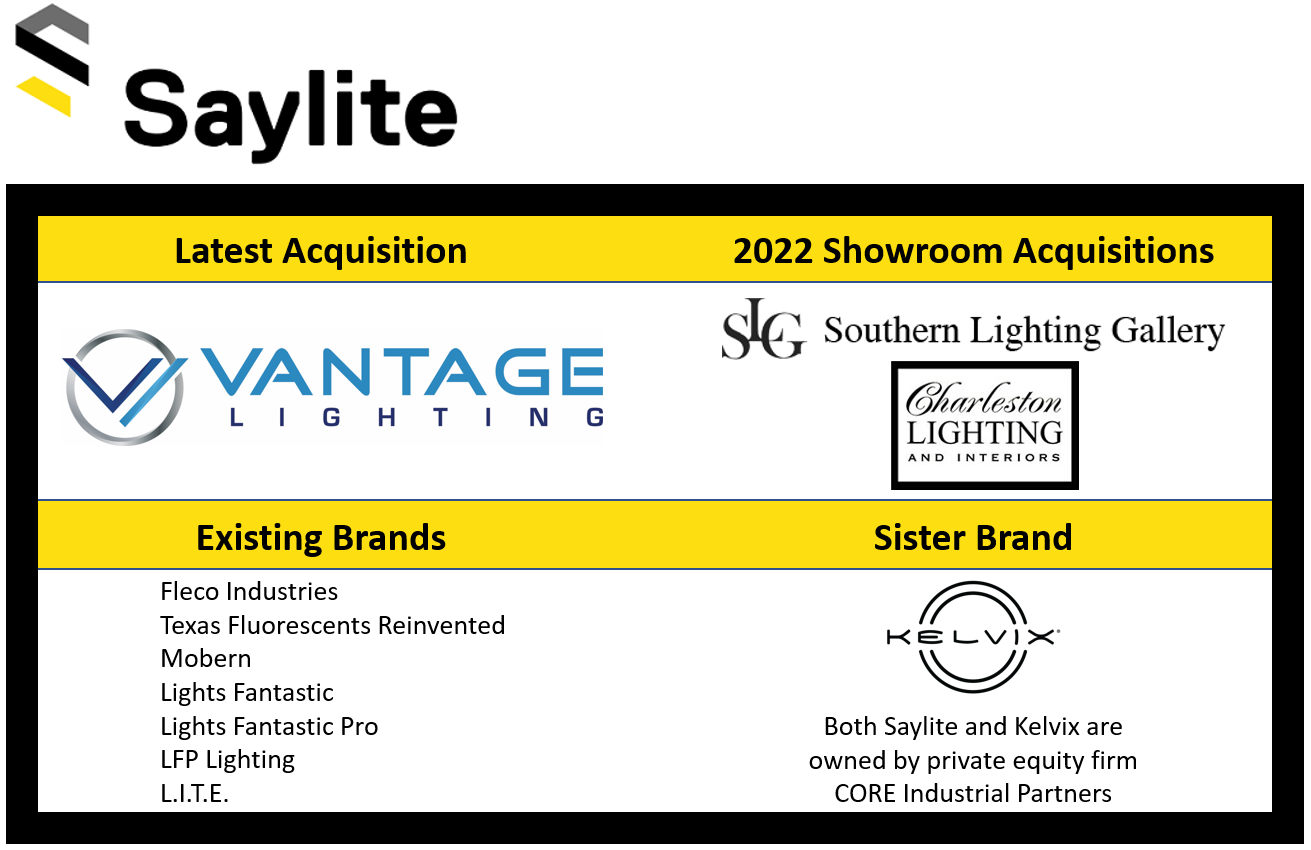

Saylite, the Texas lighting brand formerly known as Texas Fluorescents, has acquired Rhode Island downlight, cylinder and high bay maker, Vantage Lighting. Saylite, a portfolio company of CORE Industrial Partners, has been organically growing its value-focused specification product offering with its Architectural Flair family of products, and now, through acquisition, adds numerous point-source luminaires to its growing product line.

According to the company announcement, Vantage Lighting serves a diverse set of end markets, including healthcare, education, hospitality, government, and commercial real estate. Vantage offers a complete line of American-made (BAA Compliant), energy-efficient new construction and remodel luminaires. Vantage designs and builds its innovative lighting solutions in East Providence, Rhode Island.

The just-announced Vantage acquisition closed in late 2022, and is the latest of CORE Industrial Partners’ investment in lighting industry companies. Last year, Saylite acquired two lighting showrooms in the Southeastern U.S., Southern Lighting Gallery and Charleston Lighting.

Terms of the Vantage acquisition were not disclosed. Merrimack Group acted as the M&A advisor to Vantage and Gennari Aronson, LLP represented Vantage in the transaction. Norton Rose Fulbright US LLP provided legal representation to CORE Industrial Partners.

Steve Kaufman, CEO of Vantage, said, “Our new partners bring a lot of value. CORE has deep operational and financial expertise and is highly committed to our growth strategy. Saylite brings a rich history in linear lighting, strong manufacturing capabilities and significant scale. We are excited to join with them to serve our customers with a broader product portfolio.”

Chris Armstrong, CEO of Saylite, said, “We are extremely excited to have the Vantage team, product, manufacturing, and service offering join the Saylite family. Vantage and Saylite’s customers will continue to be served through each brand’s existing customer service team, as they have previously, but now with the capability to bring a broader product and service offering.”

Frank Papa, a Senior Partner at CORE, added, “Vantage’s downlighting portfolio is highly complementary, with no product overlap, to Saylite’s existing suite of lighting products. We are excited to provide our existing customers with a broader offering of products and services.”

Vantage Lighting is not affiliated with Vantage Controls, the Utah controls company that was acquired by Legrand in 2007.